BUYER SUCCESS STARTS HERE

THE QSI™ BUYER PROCESS

If you’re serious about acquiring a great business, here’s exactly how we get it done.

Deals $1M to $10M

Proven 10-step buyer process

90% success rate

CLICK BELOW TO WATCH HOW IT WORKS

90% SUCESS RATE | ZERO B.S. | RANKED #1 IN US

BUYER SUCCESS STARTS HERE

THE QSI™ BUYER PROCESS

If you’re serious about acquiring a great business, here’s exactly how we get it done.

Deals $1M to $10M

Proven 10-step buyer process

90% success rate

CLICK BELOW TO WATCH HOW IT WORKS

90% SUCESS RATE | ZERO B.S. | RANKED #1 IN US

No excuses. Just results.

100% NO 'B.S' GUARANTEE

We work with good sellers, selling good businesses, to good buyers, with good banks—where everyone wins at the closing table. No games, no wasted time, no B.S.

No excuses. Just results.

100% NO 'B.S' GUARANTEE

We work with good sellers, selling good businesses, to good buyers, with good banks—where everyone wins at the closing table. No games, no wasted time, no B.S.

BUY WITH THE #1

FINALLY ACQUIRE

THE DEAL YOU WANT

Out of 3.6 million buyers last year, only 9,546 closed a deal. Here's how to be one of the winners.

Buying a profitable, lender-ready business isn’t like scrolling Zillow—it’s a precise process.

The best deals never make it to public listings, and the ones that do attract serious attention fast.

That’s why The Deal Team uses the QSI™ Buyer Process—a step-by-step system that protects confidentiality, pre-qualifies real buyers, and moves transactions forward with clarity and confidence.

If you’re ready to own a business, this is how we make sure you’re prepared, protected, and positioned to close.

BUY WITH THE #1

FINALLY ACQUIRE

THE DEAL YOU WANT

Out of 3.6 million buyers last year, only 9,500 closed a deal. Here's how to be one of the winners.

Buying a profitable, lender-ready business isn’t like scrolling Zillow—it’s a precise process.

The best deals never make it to public listings, and the ones that do attract serious attention fast.

That’s why The Deal Team uses the QSI™ Buyer Process—a step-by-step system that protects confidentiality, pre-qualifies real buyers, and moves transactions forward with clarity and confidence.

If you’re ready to own a business, this is how we make sure you’re prepared, protected, and positioned to close.

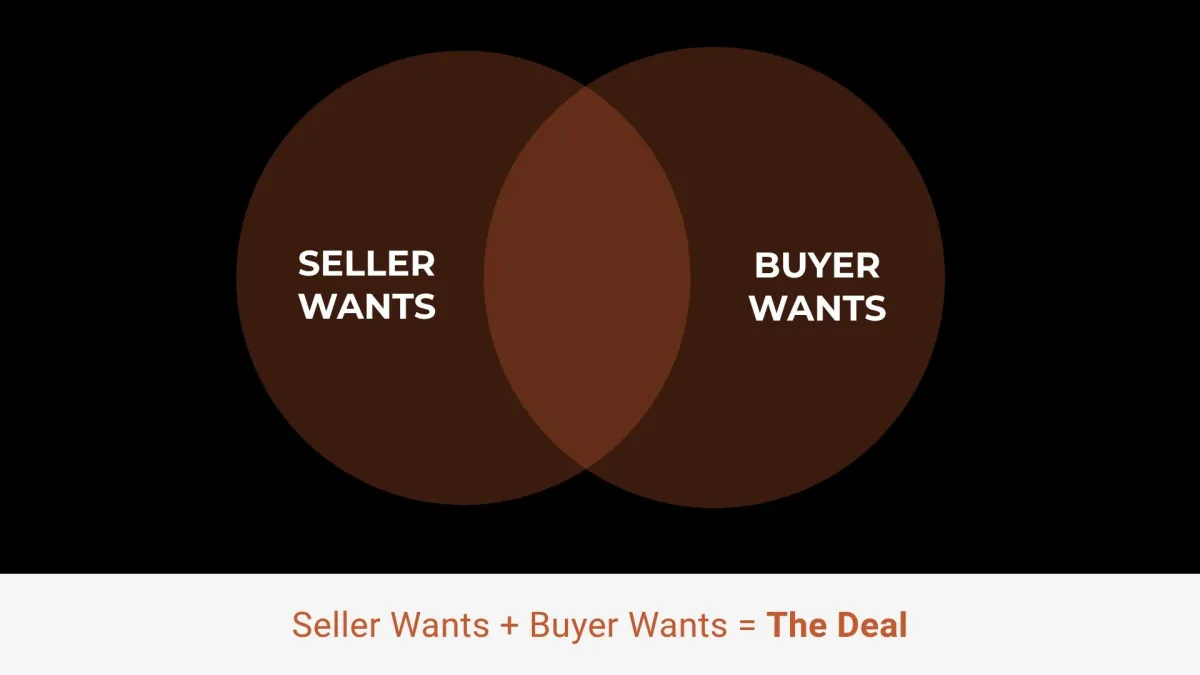

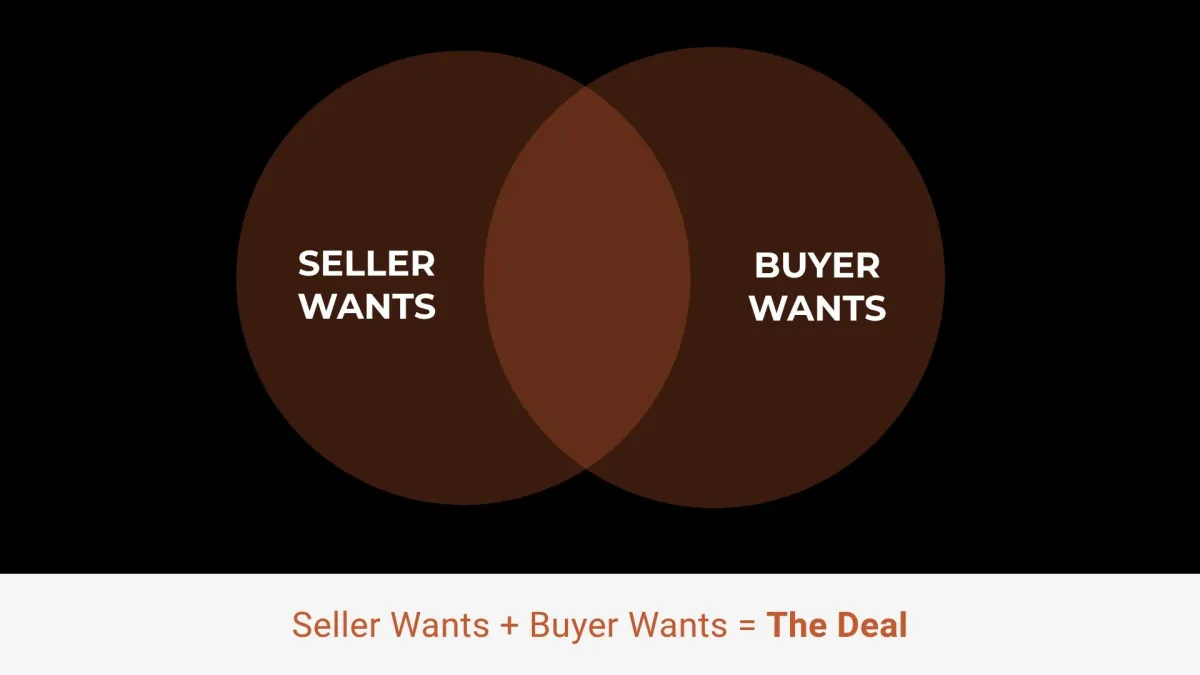

Our process is different

Before we explain our buyer process, there’s one thing you need to understand about how we operate.

We do not exclusively represent the seller.

And we do not exclusively represent you, the buyer.

What we do is represent the deal.

Our role is to clearly understand what the seller wants, what you - the buyer wants, and where those two sets of wants overlap enough to create a deal that can actually close.

That overlap is what we structure the offer around.

We advocate for the deal - and for alignment - all the way through to the closing table, so that both parties walk away with exactly what they agreed they wanted.

Common skepticism

When we start by working with sellers, buyers are often skeptical.

They assume they can’t trust us because they believe we represent the seller.

That’s not true.

And on the other hand, when we start by working with buyers, sellers are often skeptical.

They assume we’re going to take advantage of them because they believe we represent the buyer.

That’s not true either.

The reality is much simpler.

We are committed to deeply understanding what each party wants and structuring the deal to align those interests as cleanly as possible.

We do not sell businesses at a premium.

We do not sell businesses at a discount.

We sell businesses at fair market value - as determined by the SBA guidelines.

Our sellers agree to that upfront - and that discipline protects our buyers from overpaying.

And here’s the most important thing to understand:

If you don’t trust us in the deal, there is a very low chance of success.

This process only works when there is trust - in us, in the process, and in the fact that we are representing your best interest by representing the deal, period.

Our goal as your trusted advisor is to find out exactly what you want and help you get it.

With that understood, we need to address the real problem

The real problem

Buying a business isn’t hard to understand.

It’s hard to execute correctly - without interference, fear, or unnecessary complexity.

Most buyers don’t fail because the business was bad.

They fail because they disrupt a process that is proven to work.

For example…

The conventional acquisition process produces an industry success rate of only 20%.

It’s hard enough to find decent deals and if you do, the odds are greatly stacked against you to get it closed.

Contrast this with buyers who follow our QSI™ Buyer Process and close at a success rate of 90%.

This is further supported by recent BizBuySell statistics. According to BizBuySell, approximately 3.6M aspiring buyers tried to buy a business on their platform last year.

Only 9,546 were successful.

This isn’t about intelligence.

It’s about process and discipline.

The bottom line is when you follow our QSI™ process, the odds are stacked in your favor.

This process mitigates the most common deal killers.

For example…

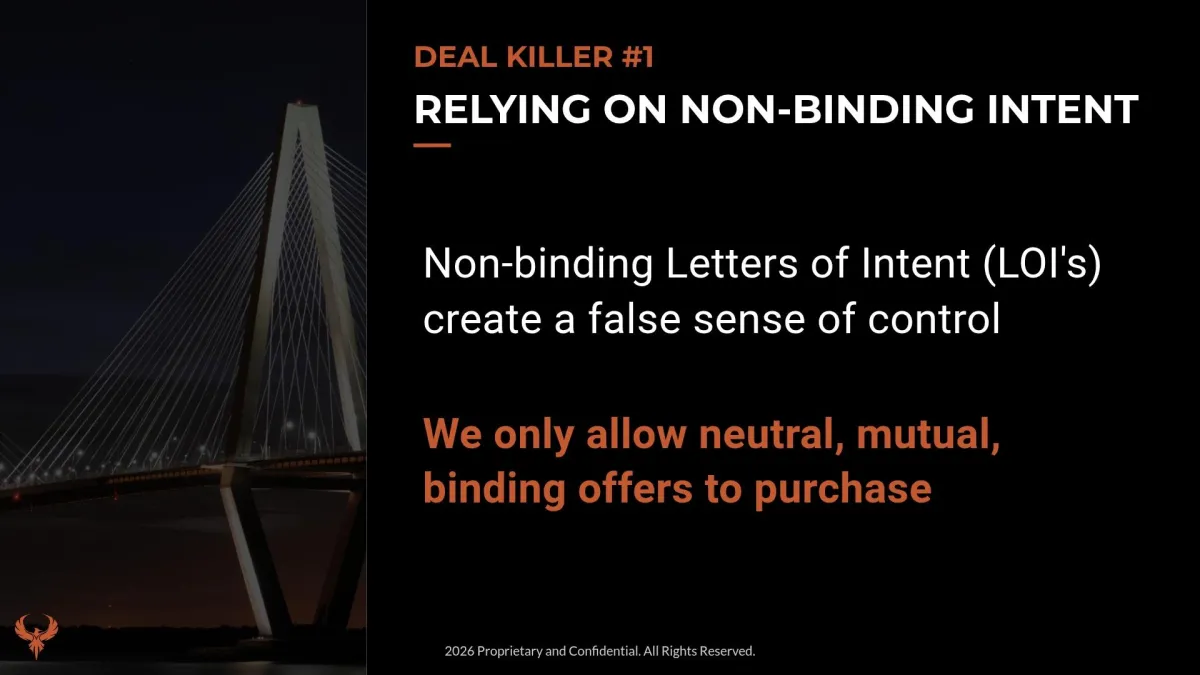

Deal Killer #1: Relying on Non-Binding Intent

On SBA deals, non-binding Letters of Intent create a false sense of control.

They feel safe - until you realize they actually put you at greater risk of wasting time, money and losing the deal.

That’s why we do not accept non-binding LOIs.

We only allow neutral, mutual, binding offers to purchase, supported by escrow, defined diligence periods, and clearly structured exit rights for you the buyer.

Protects both the buyer and the seller

Keeps leverage balanced

Ensures the deal is real from day one.

Deal Killer #2: Over-Lawyering the Deal

On SBA acquisitions, buyers already have the best lawyers in the world reviewing the deal — the SBA lender’s lawyers.

Banks have internal counsel, external counsel, appraisers and credit committees whose sole job is to protect the buyer, the bank, and the SBA guarantee.

When buyers over-lawyer, they usually slow the deal, spook the seller, and add zero additional protection.

We're not saying you shouldn't have your own attorney - in fact, we recommend it. Just don't over-lawyer the deal where it is no longer mutually beneficial.

Deal Killer #3: Double Due Diligence

SBA lender underwriting is due diligence.

It ensures:

Quality of earnings

Minimum debt service coverage ration (DSCR)

A healthy buyer salary

Adequate working capital

Contingency cash flow

Appraisals

Third-party business valuations

And that the business is sustainable and scalable for you, the buyer

The SBA has been analyzing and funding acquisitions for over 70 years. They are the best in the world at facilitating due diligence.

In fact, their acquisition loan failure rate is 1 out of 72 - this means that if you buy an SBA-approved deal, you have a 99.9% chance of buying a sustainable business.

Duplicating underwriting doesn’t make the deal safer and adds significant and unnecessary additional costs.

Individual due diligence typically costs the buyer an additional $25,000 to $75,000+ on average and delays closing, or worse.

You will have a dedicated due diligence coordinator on our team who is an SBA expert guiding you through the entire process all the way to closing making sure you are protected.

Deal Killer #4: Not Agreeing To Neutral Third-Party Vendors

Purchase agreements should be drafted by neutral attorneys.

Escrow should be handled by neutral title companies.

When buyer attorneys and seller attorneys negotiate directly, fees skyrocket and deals die.

Control doesn’t come from owning the paper.

It comes from structure.

And this structure will save you tens of thousands of dollars and prevent the deal from dying.

Deal Killer #5: Fear-Based Over-Analysis

Fear often disguises itself as diligence.

Endless modeling, last-minute advisors, one more opinion - this is how deals die.

And we get it, acquiring a business can be daunting.

But just remember, if the SBA has approved the deal, you're as protected as you can be.

The SBA Advantage

The SBA acquisition framework has existed since Eisenhower was in office.

It has analyzed millions of deals.

The SBA acquisition loan failure and default rate is approximately 1 out of every 72 deals.

No individual buyer or their advisors can outperform the SBA’s underwriting system.

It protects buyer income, downside risk, and long-term sustainability — while saving buyers tens of thousands of dollars in unnecessary diligence.

They simply will not let you close a bad deal.

Become an expert dealmaker with QSI™

When you follow our QSI™ process, you’ll buy your business like an expert dealmaker:

First, we’ll gather pre-qualification in the form of an NDA, personal financial statement, and proof of funds.

Then, we’ll have a brief initial call to discuss potential fit.

Next, we’ll provide you the confidential business information, also known as a CIM, so you can see if it meets what you’re looking for.

Then, if you’re interested, we’ll schedule a meeting with the seller so both parties can determine potential fit.

Next, if that goes well, we’ll help you craft a winning offer and make sure you’re protected.

Then, we move into due diligence where you’ll have a dedicated advisor on our team to guide you through all the way to the closing table.

Next, you’ll sign a few documents and actually close the deal.

And finally, you’ll start your transition with the seller as the new owner.

It really is this simple… IF you follow the process.

Our role is to enforce structure, reduce risk, and prevent interference.

Your role is to follow the process, commit capital, make timely decisions, and avoid emotional overrides.

The safest way to buy a business isn’t more control.

It’s the right structure - executed with discipline - and without interference.

THIS is how expert dealmakers get deals done.

Thank you for taking the time to better understand our buyer process and how you can buy the business you want like an expert dealmaker. We look forward to working with you.

You’re only one acquisition away from the wealth, time, and freedom you deserve.

Our process is different

Before we explain our buyer process, there’s one thing you need to understand about how we operate.

We do not exclusively represent the seller.

And we do not exclusively represent you, the buyer.

What we do is represent the deal.

Our role is to clearly understand what the seller wants, what you - the buyer wants, and where those two sets of wants overlap enough to create a deal that can actually close.

That overlap is what we structure the offer around.

We advocate for the deal - and for alignment - all the way through to the closing table, so that both parties walk away with exactly what they agreed they wanted.

Common skepticism

When we start by working with sellers, buyers are often skeptical.

They assume they can’t trust us because they believe we represent the seller.

That’s not true.

And on the other hand, when we start by working with buyers, sellers are often skeptical.

They assume we’re going to take advantage of them because they believe we represent the buyer.

That’s not true either.

The reality is much simpler.

We are committed to deeply understanding what each party wants and structuring the deal to align those interests as cleanly as possible.

We do not sell businesses at a premium.

We do not sell businesses at a discount.

We sell businesses at fair market value - as determined by the SBA guidelines.

Our sellers agree to that upfront - and that discipline protects our buyers from overpaying.

And here’s the most important thing to understand:

If you don’t trust us in the deal, there is a very low chance of success.

This process only works when there is trust - in us, in the process, and in the fact that we are representing your best interest by representing the deal, period.

Our goal as your trusted advisor is to find out exactly what you want and help you get it.

With that understood, we need to address the real problem

The real problem

Buying a business isn’t hard to understand.

It’s hard to execute correctly - without interference, fear, or unnecessary complexity.

Most buyers don’t fail because the business was bad.

They fail because they disrupt a process that is proven to work.

For example…

The conventional acquisition process produces an industry success rate of only 20%.

It’s hard enough to find decent deals and if you do, the odds are greatly stacked against you to get it closed.

Contrast this with buyers who follow our QSI™ Buyer Process and close at a success rate of 90%.

This is further supported by recent BizBuySell statistics. According to BizBuySell, approximately 3.6M aspiring buyers tried to buy a business on their platform last year.

Only 9,546 were successful.

This isn’t about intelligence.

It’s about process and discipline.

The bottom line is when you follow our QSI™ process, the odds are stacked in your favor.

This process mitigates the most common deal killers.

For example…

Deal Killer #1: Relying on Non-Binding Intent

On SBA deals, non-binding Letters of Intent create a false sense of control.

They feel safe - until you realize they actually put you at greater risk of wasting time, money and losing the deal.

That’s why we do not accept non-binding LOIs.

We only allow neutral, mutual, binding offers to purchase, supported by escrow, defined diligence periods, and clearly structured exit rights for you the buyer.

Protects both the buyer and the seller

Keeps leverage balanced

Ensures the deal is real from day one.

Deal Killer #2: Over-Lawyering the Deal

On SBA acquisitions, buyers already have the best lawyers in the world reviewing the deal — the SBA lender’s lawyers.

Banks have internal counsel, external counsel, appraisers and credit committees whose sole job is to protect the buyer, the bank, and the SBA guarantee.

When buyers over-lawyer, they usually slow the deal, spook the seller, and add zero additional protection.

We're not saying you shouldn't have your own attorney - in fact, we recommend it. Just don't over-lawyer the deal where it is no longer mutually beneficial.

Deal Killer #3: Double Due Diligence

SBA lender underwriting is due diligence.

It ensures:

Quality of earnings

Minimum debt service coverage ration (DSCR)

A healthy buyer salary

Adequate working capital

Contingency cash flow

Appraisals

Third-party business valuations

And that the business is sustainable and scalable for you, the buyer

The SBA has been analyzing and funding acquisitions for over 70 years. They are the best in the world at facilitating due diligence.

In fact, their acquisition loan failure rate is 1 out of 72 - this means that if you buy an SBA-approved deal, you have a 99.9% chance of buying a sustainable business.

Duplicating underwriting doesn’t make the deal safer and adds significant and unnecessary additional costs.

Individual due diligence typically costs the buyer an additional $25,000 to $75,000+ on average and delays closing, or worse.

You will have a dedicated due diligence coordinator on our team who is an SBA expert guiding you through the entire process all the way to closing making sure you are protected.

Deal Killer #4: Not Agreeing To Neutral Third-Party Vendors

Purchase agreements should be drafted by neutral attorneys.

Escrow should be handled by neutral title companies.

When buyer attorneys and seller attorneys negotiate directly, fees skyrocket and deals die.

Control doesn’t come from owning the paper.

It comes from structure.

And this structure will save you tens of thousands of dollars and prevent the deal from dying.

Deal Killer #5: Fear-Based Over-Analysis

Fear often disguises itself as diligence.

Endless modeling, last-minute advisors, one more opinion - this is how deals die.

And we get it, acquiring a business can be daunting.

But just remember, if the SBA has approved the deal, you're as protected as you can be.

The SBA Advantage

The SBA acquisition framework has existed since Eisenhower was in office.

It has analyzed millions of deals.

The SBA acquisition loan failure and default rate is approximately 1 out of every 72 deals.

No individual buyer or their advisors can outperform the SBA’s underwriting system.

It protects buyer income, downside risk, and long-term sustainability — while saving buyers tens of thousands of dollars in unnecessary diligence.

They simply will not let you close a bad deal.

Become an expert dealmaker with QSI™

When you follow our QSI™ process, you’ll buy your business like an expert dealmaker:

First, we’ll gather pre-qualification in the form of an NDA, personal financial statement, and proof of funds.

Then, we’ll have a brief initial call to discuss potential fit.

Next, we’ll provide you the confidential business information, also known as a CIM, so you can see if it meets what you’re looking for.

Then, if you’re interested, we’ll schedule a meeting with the seller so both parties can determine potential fit.

Next, if that goes well, we’ll help you craft a winning offer and make sure you’re protected.

Then, we move into due diligence where you’ll have a dedicated advisor on our team to guide you through all the way to the closing table.

Next, you’ll sign a few documents and actually close the deal.

And finally, you’ll start your transition with the seller as the new owner.

It really is this simple… IF you follow the process.

Our role is to enforce structure, reduce risk, and prevent interference.

Your role is to follow the process, commit capital, make timely decisions, and avoid emotional overrides.

The safest way to buy a business isn’t more control.

It’s the right structure - executed with discipline - and without interference.

THIS is how expert dealmakers get deals done.

Thank you for taking the time to better understand our buyer process and how you can buy the business you want like an expert dealmaker. We look forward to working with you.

You’re only one acquisition away from the wealth, time, and freedom you deserve.

WORK WITH THE #1

BOOK A CONSULTATION

Schedule a complimentary, no b.s., no obligation consultation to see if The Deal Team and QSI™ are right for you.

THE DEAL TEAM

SELLERS

BUYERS

PETERSON ACQUISITIONS

LEGAL

© Copyright 2026. The Deal Team. All Rights Reserved.

WORK WITH THE #1

BOOK A CONSULTATION

Schedule a complimentary, no b.s., no obligation consultation to see if The Deal Team and QSI™ are right for you.

THE DEAL TEAM

SELLERS

BUYERS

PETERSON ACQUISITIONS

LEGAL

© Copyright 2026. The Deal Team. All Rights Reserved.